If you sell goods and/or services to another business and both of you are registered for VAT, you will generally need to send them a VAT invoice and keep appropriate records. There is certain information a VAT invoice must show by law, and our template contains all the legally required information. You can also purchase this template as part of the Starting an online business toolkit and/or the Debt collection toolkit.

If you sell goods and/or services to another business and both of you are registered for VAT, you will generally need to send them a VAT invoice and keep appropriate records. There is certain information a VAT invoice must show by law, and our template contains all the legally required information. You can also purchase this template as part of the Starting an online business toolkit and/or the Debt collection toolkit.

What a VAT invoice must show depends on who you’re selling to and what type of sale you’re making. For example, you can provide a simplified VAT invoice if you’re making UK retail sales of £250 (including VAT) or less. You may also be able to issue simplified invoices in other circumstances; if you aren’t sure what types of VAT invoices you are required to issue, speak to your accountant.

Bear in mind that VAT invoices must usually be issued within 30 days of the date you supply the goods or services or, if you’re paid in advance, within 30 days of the date of payment.

You won’t need to issue a VAT invoice in certain circumstances; see our recent blog for further guidance on when you don’t need to send a VAT invoice.

This blog sets out the usual invoice requirements for UK sales requiring full VAT invoices, the requirements for simplified VAT invoices for retail sales of £250 or less, and the requirements for non-VAT invoices.

What a VAT invoice must show

UK sales requiring full VAT invoices

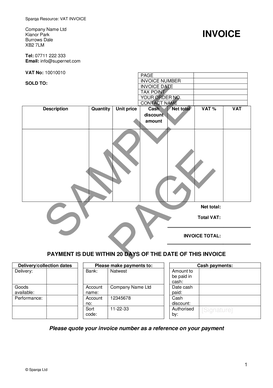

If you are required to produce a full VAT invoice (for most sales over £250, including VAT), you will normally need to ensure that it contains the following information:

- a unique invoice number that follows on from the last invoice you sent (using sequential numbering);

- your business name, address and VAT registration number;

- the date of the invoice;

- the name and address of the customer you’re invoicing;

- a clear description of the goods or services provided, including quantity of goods or extent of the services;

- when the goods were sent, collected or made available or the services were performed;

- the rate of any cash discount;

- the applicable rate(s) of VAT. If some of the goods or services are exempt from VAT or zero-rated, it should be made clear that no VAT is being charged for those goods or services;

- the total amount excluding VAT;

- the total amount of VAT (this must be expressed in sterling); and

- the total price payable including VAT.

UK retail customers making purchases of £250 (including VAT) or less

In these circumstances you can provide a simplified VAT invoice, which means you only need to include the following information:

- your business name, address and VAT registration number;

- a clear description of the goods or services provided (the invoice should not contain any reference to any goods or service exempt from VAT);

- when the goods were sent, collected, or made available or the services were performed;

- the applicable rate(s) of VAT;

- if more than one rate of VAT is applicable, the total amount payable including VAT for each rate; and

- the total price including VAT.

The contents of non-VAT invoices

Non-VAT invoices should contain enough information to secure payment from the customer and act as a record of the transaction. As such, you should ensure the following information is included:

- a title indicating that it is an invoice (rather than, for example, a receipt);

- if your business is a registered company, its full registered name, number and office;

- your contact details;

- the customer’s name and address;

- the date of the invoice;

- a unique identifying number (so that this invoice is not confused for another one);

- a detailed breakdown of what you’re charging for and when it was supplied;

- the price of each item in the breakdown;

- the total price; and

- the date for payment together with any details about acceptable methods of payment.

See Non-VAT invoice for a template you can use.

Submitting VAT returns

If you are required to register for VAT, you will need to submit VAT returns showing how much VAT you owe to HMRC every three months. See this blog for details on when and how to register for VAT.

Since 1 April 2022, all VAT registered entities are required to keep digital records and submit VAT returns to HRMC using compatible software.

If you are in doubt about whether or how these requirements apply to you, you should speak to your accountant and/or HMRC.

The content in this article is up to date at the date of publishing. The information provided is intended only for information purposes, and is not for the purpose of providing legal advice. Sparqa Legal’s Terms of Use apply.

Marion joined Sparqa Legal as a Senior Legal Editor in 2018. She previously worked as a corporate/commercial lawyer for five years at one of New Zealand’s leading law firms, Kensington Swan (now Dentons Kensington Swan), and as an in-house legal consultant for a UK tech company. Marion regularly writes for Sparqa’s blog, contributing across its commercial, IP and health and safety law content.